NEWS

Rising Fees, Falling Audiences Highlight Pay TV Dilemma

May 29, 2019

Jessica Toonke

Cable channels have long been the cash machine for the entertainment industry thanks to a quirk in their business model. Cable and satellite TV firms pay channels fees for each subscriber who has the channels available in their service package, regardless of whether anyone watches the channels. AT&T, owner of DirecTV, is trying to change that—with far-reaching implications for the TV industry’s profitability.

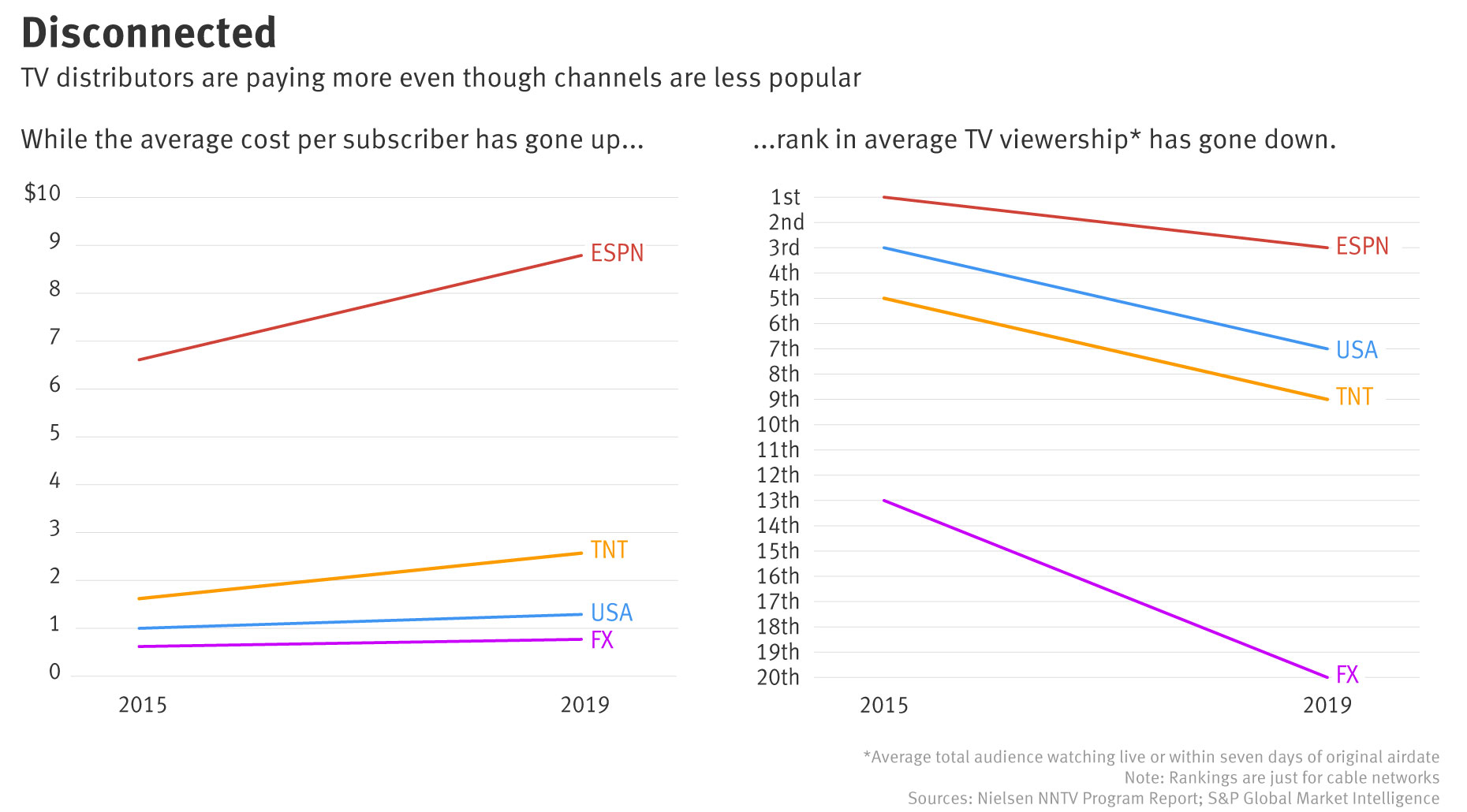

AT&T wants to pay channels based on how many people actually watch, rather than the number of subscribers who have access to the channels. The idea is driven by two major trends. Firstly, a growing number of consumers are canceling their expensive cable and satellite packages in favor of cheaper streaming services. Meanwhile, TV channels are charging distributors like DirecTV more for the right to carry them even as the channels’ audiences are shrinking (see chart above).

THE TAKEAWAY

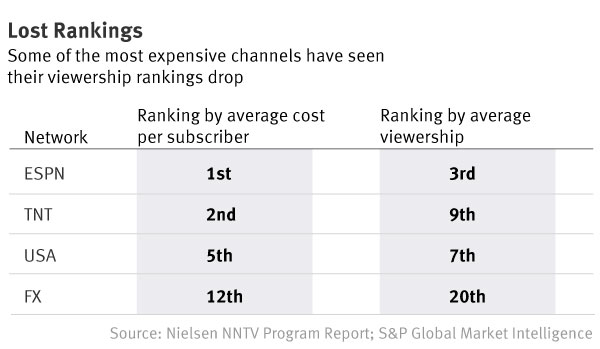

Cable channels such as ESPN, TNT and USA have sharply raised the price they charge pay TV operators even as their audiences have shrunk. That is widening a gap between audience and cost and is driving AT&T’s push for paying channels based on the size of their audience.

For example, Disney’s ESPN has fallen from the most-watched cable channel in 2015 to the third most-watched while the per-subscriber fees that cable and satellite operators pay for ESPN have jumped 33%, according to data from S&P Global Market Intelligence and Nielsen. (Even before that increase, ESPN was the most expensive channel for pay TV operators to carry.) Meanwhile, WarnerMedia’s TNT has fallen from the fifth most-watched cable channel in 2015 to the ninth. Yet the price per subscriber that distributors pay for the channel has jumped by 59%. TNT is the second most expensive channel for distributors to carry.

Similarly, Disney’s FX is the 20th most-watched cable channel, but the 12th most-expensive to carry. Meanwhile, Comcast’s USA has fallen from the third most-watched cable channel in 2015 to the seventh, but the price per subscriber that distributors pay has risen from $1 a month to $1.29.

If AT&T can shift to paying for channels based on their audience size, it could reduce programming costs for its DirecTV and phone-based TV service U-verse and potentially lead other cable and satellite operators to follow suit, sparking a revolution in television. For years, cable and satellite services have complained that programming costs were too high. They can account for more than 60% of video-related revenue.

AT&T’s effort to get entertainment companies to agree to get paid for actual viewers of their shows is in its infancy and it faces long odds.

AT&T’s effort to get entertainment companies to agree to get paid for actual viewers of their shows is in its infancy and it faces long odds. “This is probably the greatest negotiating friction in all the businesses,” AT&T Communications CEO John Donovan told The Information last summer when asked about the company’s discussions around so-called engagement pricing.

But it is experimenting. Last year it launched AT&T Watch TV, a video streaming service that includes a number of channels such as TNT and Comedy Central. The service is free for AT&T wireless subscribers with unlimited data, and for those customers, AT&T only pays entertainment companies for viewers who watch the app at least three consecutive minutes per month, according to people familiar with the situation.

The service also is available as a $15 per month subscription-based service in which AT&T pays the entertainment companies a certain negotiated amount based on the number of subscribers who pay for the app. AT&T is discussing how it can expand the model of paying for actual viewership to other offerings, a person familiar AT&T’s thinking said.

Complicating AT&T’s plan is that it now owns WarnerMedia, previously called Time Warner, one of the biggest collections of cable channels, which could lose revenue if fees were more aligned with audience size—as TNT’s disproportionately high fees demonstrate.

But AT&T may feel it has more to gain overall from cutting costs at its DirecTV business than from holding on to the current business model, which delivers those lucrative access fees to WarnerMedia. Based on AT&T’s disclosures and Time Warner’s last earnings statements, WarnerMedia’s pay TV subscription revenues are likely around $14 billion a year. But AT&T’s DirecTV and U-verse likely pay more than $19 billion in programming costs. That suggests a 10% reduction in fees would overall benefit AT&T.

Read More:

https://www.theinformation.com/articles/rising-fees-falling-audiences-highlight-pay-tv-dilemma

then "Add to Home Screen"

then "Add to Home Screen"